Bitcoin has crossed US$50,000 mark for the first time since 2021 after two long years in anticipation of the 4th Bitcoin halving in April 2024. Experts are saying that this Bitcoin halving could mark the beginning of a new bull run for digital assets, pushing Bitcoin beyond any historic all-time highs.

Manhar Garegrat, Country Head, India & Global Partnerships at Liminal Custody Solutions, says historically, Bitcoin Halvings are basically events that significantly reduce the Bitcoin supply and have always led to positive price action for Bitcoin.

This time around, there is a heightened expectation from the halving due to the inception of Bitcoin spot ETFs which have increased the demand for Bitcoin as investments have surged to a volume of over $50B in barely a month since approval in Mid-January 2024

Manhar Garegrat, Country Head, India & Global Partnerships at Liminal Custody Solutions

“This time around, there is a heightened expectation from the halving due to the inception of Bitcoin spot ETFs which have increased the demand for Bitcoin as investments have surged to a volume of over $50B in barely a month since approval in Mid-January 2024,” he says.

He adds that if this increased demand continues, the Bitcoin halving could mark the beginning of a new bull run for digital assets pushing Bitcoin beyond any historic all-time highs.

Approved Bitcoin ETFs

The recent US SEC green signal to Bitcoin ETFs caused quite a stir recently. Ryan Lee, Chief Analyst at Bitget Research also says that the current surge of Bitcoin’s price is mainly due to reasons like the US SEC officially approved the Bitcoin ETF.

“This allows investors around the world to invest in Bitcoin through compliance channels. This will undoubtedly bring more attention and capital injection to Bitcoin,” he explains.

The presence of a regulated Bitcoin ETF in the US has not only boosted the mass adoption of digital assets but has also acted as a solid template for other developing economies to leverage the true potential of digital assets. This just goes to show that investors are keen to invest, however they continue sitting on the fence as they await a nod from the authorities

Ryan Lee, Chief Analyst at Bitget Research

There was a short-term decline after the adoption of the Bitcoin ETF. This was due to the switching of positions by some holders of Grayscale and the selling of some equity holders.

“As the grayscale sell-off came to an end, the overall Bitcoin ETF market began to see daily net inflows in and out, and this rhythm is still maintained. BlackRock, for example, has opened its own sales network to sell Bitcoin ETFs,” he further adds.

“The presence of a regulated Bitcoin ETF in the US has not only boosted the mass adoption of digital assets but has also acted as a solid template for other developing economies to leverage the true potential of digital assets. This just goes to show that investors are keen to invest, however they continue sitting on the fence as they await a nod from the authorities,” he opines.

Macro Factors Matter

With Bitcoin crossing the US$50,000 mark for the first time in two years, the total crypto market capitalisation has risen to US$1.87T.

Shivam Thakral, CEO of BuyUcoin, says crossing the US$50,000 mark was expected. “As expected, Bitcoin soared to $50,000 after holding and breaking above the $49,000 support. On the other hand, Ethereum is trying to break the $2700 resistance which might be successful when Bitcoin dominance decreases from the current 52%.”

The macro factors such as the anticipated rate cut by the US Fed and the growing popularity of Bitcoin ETFs will drive the market in the mid to long term. We can expect Bitcoin to retest its all-time high of $69,000 post-halving

Shivam Thakral, CEO of BuyUcoin

There are Approximately 60 days until the Bitcoin Halving in April 2024 which could potentially push the cryptocurrency market to new highs.

“The macro factors such as the anticipated rate cut by the US Fed and the growing popularity of Bitcoin ETFs will drive the market in the mid to long term. We can expect Bitcoin to retest its all-time high of $69,000 post-halving,” he predicts.

It was yesterday that Bitcoin (BTC) hit the US$49,500 marking a new high since December 2021. Lee says that the impact of Bitcoin Spot ETFs and market’s anticipation for Bitcoin Halving in May plays a vital role in the market surge.

“From 1st Jan 2024 to Jan 10th (Bitcoin ETF approval date), BTC trading volumes grew from $16B to $50B – a 300% increase. This is the impact of the approved BTC ETF. However, the effects of Bitcoin Halving are yet to factor in,” he says.

Bitcoin rose by about 12% in the second week of February 2024, with the currency price reaching a maximum of US$48,800, which has now reached the integer mark of US$50,000.

Read more: Businesses scramble to provide embedded finance to satisfy the new age digital Indian consumer

In the last bull market, the price of Bitcoin was between US$38,000 and US$48,000, which was the main trading range, and a large number of chips were concentrated in this position, says Lee.

Bitcoin’s fourth halving is coming soon, and the market is confident that the price of Bitcoin will reach a record high after this halving.

“At the same time, the Federal Reserve will also start an interest rate cut cycle this year, which is a good signal for risk assets and emerging markets. A series of excellent projects have built on the Bitcoin ecosystem, which has promoted its further development, increasing the demand for its underlying asset BTC. This allows more players to participate in the Bitcoin ecosystem increasing its awareness and adoption globally,” he says.

The History of Bitcoin Halving Highs

Lee reiterates that historically Bitcoin Halvings have resulted in driving BTC prices to new ATHs in the preceding year. The first halving occurred in November 2012. Within one year, the price of Bitcoin rose from a high of US$13 to US$1,152 (in December 2013) and reached its peak one year and one month after the halving.

As of now, there’s no upcoming news that may have a price correlation with Bitcoin except the halving, which may provide returns in the medium to long term. It’s also important to take market’s psychological levels, such as BTC prices ranging from $50K to previous ATH, which may cause larger price retracements

Ryan Lee, Chief Analyst at Bitget Research

The second halving occurred in July 2016, when the price of Bitcoin rose from a high of US$664 to US$17,760 (December 2017), reaching its peak one year and five months after the halving. The third halving occurred in May 2020, when the price of Bitcoin rose from a high of US$9,734 to US$67,549 (April-November 2021), reaching its peak one year and six months after the halving.

The fourth halving will occur in April 2024. It is expected that the price of Bitcoin will rise from the highest point in the US dollar to the US dollar (April-November 2021), and the price is expected to peak one year and five months after the halving. A similar trend has been observed with the previous three halvings with prices increasing over to hit a new BTC price ATH.

“As of now, there’s no upcoming news that may have a price correlation with Bitcoin except the halving, which may provide returns in the medium to long term. It’s also important to take market’s psychological levels, such as BTC prices ranging from $50K to previous ATH, which may cause larger price retracements,” he explains.

Global Sentiment Regarding BTC Halving Optimistic

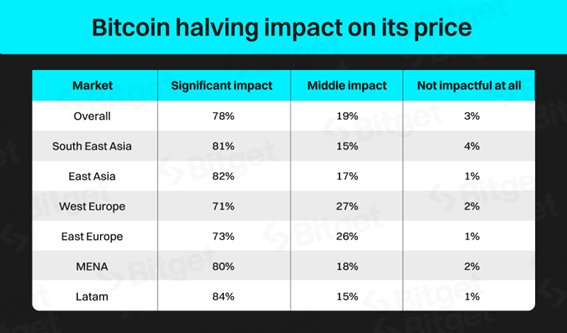

According to a Bitget study on BTC halving, there is a widespread belief in the significant impact of Bitcoin halving on its price, with approximately 78% of investors expressing this sentiment globally.

Optimism is notably high in Latin America, East Asia, and SouthEast Asia markets, with 84%, 82%, and 81% foreseeing a substantial impact. Emerging economies in MENA also express a keen interest, with proportions around 80%. West Europe and East Europe exhibit relative caution, with proportions at 71%% and 73%, respectively.

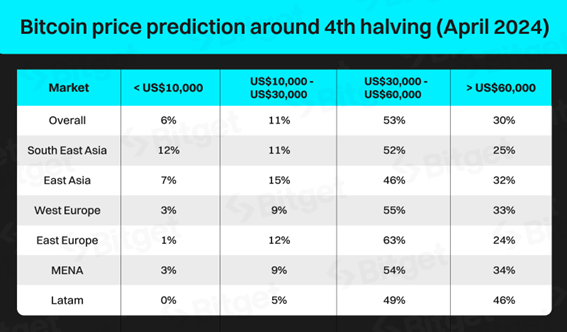

The investor predictions for Bitcoin’s price around the 4th halving in April 2024 vary across markets. Approximately, 53% of investors globally anticipate the price fluctuating between US$30,000 and US$60,000, while 30% believe it would break US$60,000.

Latin America stands out as a particularly optimistic market, with 46% of investors expecting prices to exceed $60,000 and 49% thinking it will range between $30,000 and $60,000.

55% of investors predict the next bull market will fluctuate between $50,000 and $100,000, while 8% of investors expect prices to exceed $150,000.

Looking ahead to 2024, approximately 70% of investors express plans to increase their crypto investments. Higher proportions in MENA and East Europe indicate a stronger inclination to increase investments. Meanwhile, more investors in South East Asia and East Asia show a preference for maintaining their current investment positions.

The World is Getting Crypto Ready

Already, cryptocurrencies adoption are breaking records across the world. As per a study conducted by Coinwire, New York ranks the most crypto-ready city, with 85.85/100 score, while Tokyo ranks the least crypto-ready, with 52.84/100 score. Los Angeles, Singapore and Rome too stand out at 85.85/100. In fact, Los Angeles is the city with the most crypto ATMs (1810 ATMs) in the world.