Can Micro, Small and Medium Enterprises (MSMEs) reach out to the rural unbanked population of India through FinTech?

India may be shining on the FinTech stage with investors queueing up to fund startups in the space, but how many Indians are able to access this progress?

Without a doubt, technology in banking has come a long way. Indian banks are developing alternate electronic delivery channels rapidly. For example, the number of point of sales terminals are up from 12,11,890 in 2015 to 45,89,727 in 2019. The number of debit cards also soared from 604 million to almost 835 million during the same period.

Read more: Branchless banking: Bank branches are moving from the street into our devices

Encouraged by a spike in digitisation, for example e-commerce going up in Tier 2-3 cities, around 1,200 FinTech companies team up with banks to grow their digital outreach in several forms. The UPI platform includes 45 wallet players, 50 UPI-based payments service providers, and 142 banks actively cooperating to provide services to customers.

Globally, India ranked fifth among 55 countries in Global Microscope-2019’s report on the ‘enabling environment for financial inclusion and the expansion of digital financial services’ released by Economic Intelligence Unit.

Indian banks have embraced digitisation. For instance, using Facebook, ICICI lets users connect their debit card to their Facebook profile to recharge their pre-paid mobile phone and transact (borrow and lend money).

Lack of smartphone usage, language barriers, and digital illiteracy are the challenges that rural India still faces

Still, 1.3 billion Indians can’t access basic banking services.

Doubtless, the number of basic savings bank deposit accounts has increased because of the Pradhan Mantri Jan Dhan Yojana (PMJDY). However, the World Bank data shows that 47% of these accounts are inoperative and 23% remain dormant.

Lack of smartphone usage, language barriers, and digital illiteracy are the challenges that rural India still faces.

“Most of the Indian population is digitally illiterate and prefer their own languages,” Mitesh Thakker, Founder of MissCallPay, a startup that has built a payment solution that adapts to the habits of the masses, told The Tech Panda.

Mitesh Thakker

The real financial inclusion in rural areas will be when people will transact by themselves without assistance from others

“They can only speak or listen, so it becomes difficult for them to read the instructions while making payments. The FinTech apps till now are not providing a solution to this challenge. The real financial inclusion in rural areas will be when people will transact by themselves without assistance from others,” he adds.

AI ML Blockchain to the Rescue

Emerging technology like Artificial intelligence (AI), machine learning (ML), and blockchain in banking can change the FinTech game in rural India. Such tech can be put to practical usage in digitally poor areas.

“AI, ML, and big data have equipped lenders to measure individual customer insights and build alternative credit scoring models. Mobile and smartphone penetration has enabled us to connect with customers with low incomes,” says Thakker.

For example, an AI Gov article by Data Scientist, Sray Agarwal, suggests that AI can build up credit score or credit-worthiness scores with the help of data from various centrally governed social security numbers and farming turnover. It can also analyse affordability on the basis of mobile data, such as usage, bills, and recharge frequency.

FinTech players are efficiently making use of new-age technologies to overcome challenges and build products and services as per each segment’s requirements. These technologies will help in making the process automated, addressing new markets, and better compliance with frauds and monitoring

Predictive modelling and ML algorithms can even scour social network, cell phone call logs, travel information from GPS data, etc. While this sounds kind of creepy, the fact is that ML algorithm can eventually build credit profiles for those excluded from banking. In fact, world over, it is already in practice.

ML can be put to use in rural India, by applying to PM Jan Dhan accounts, which are already linked to Aadhar numbers. Analysing these transaction behaviours can help predict and recommend the right products in remote areas.

“FinTech players are efficiently making use of new-age technologies to overcome challenges and build products and services as per each segment’s requirements. These technologies will help in making the process automated, addressing new markets, and better compliance with frauds and monitoring,” adds Thakker.

Adding Voice for Rural FinTech

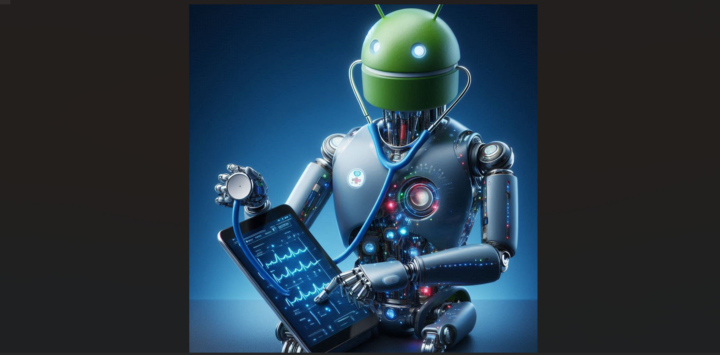

Since language is one of the key challenges to overcome in reaching out to rural populations, voice technology can help in bringing them closer to FinTech inclusion.

“Lots of Indians can only verbally converse in their own language. Many of them can’t read and write. A large portion of the rural population is digitally illiterate, and at the same time, they are numerically literate,” explains Thakker.

AI has the ability to easily use NRLP (Natural Regional Language processing) to access rural areas from a toll-free mobile number at any given hour of the day. This can make for a richer customer experience with communication occurring in local dialects

MissCallPay was created keeping these audiences in mind who are not comfortable in reading and writing or only own a feature phone. The platform makes it possible for them to transact in their own languages by following simple voice based instructions.

“AI has the ability to easily use NRLP (Natural Regional Language processing) to access rural areas from a toll-free mobile number at any given hour of the day. This can make for a richer customer experience with communication occurring in local dialects,” he adds.

MSMEs Can Ensure Financial Inclusion in Rural India

One of the reasons that the rural population can’t transact is either because they only have a feature phone or lack the understanding of using smartphones. Technology can play a vital role to help MSMEs in reaching out to these population, says Thakker.

“The advancement in technology can help in providing an easy and simple medium for payments and transactions. It can also be helpful in the areas with a very low or with no network coverage,” he says.