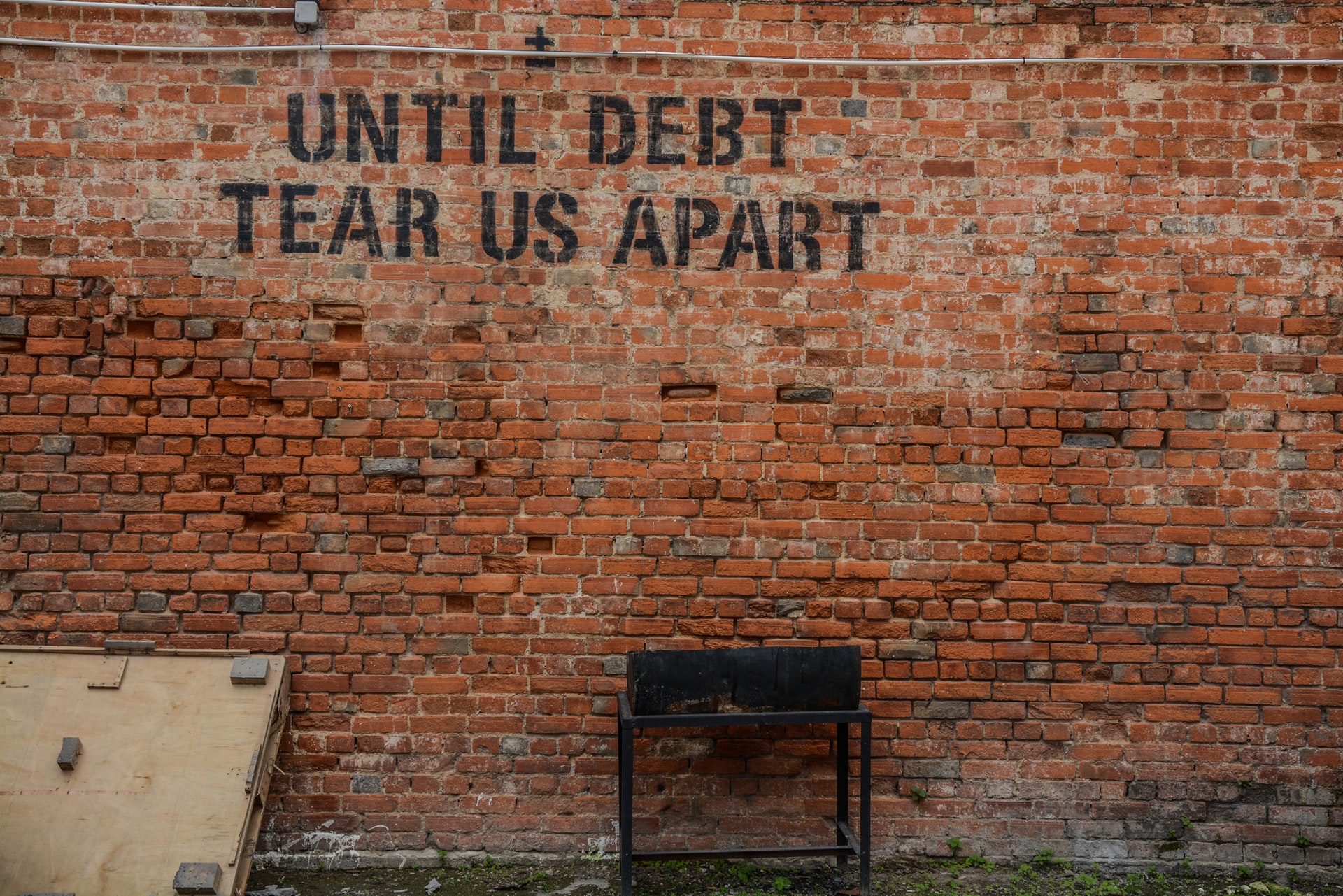

The recession is coming. Time to take out our umbrellas.

Economists polled by Reuters again slashed growth forecasts for key economies while central banks keep increasing interest rates to knock down stubbornly-high inflation.

The US Federal Reserve increased interest rates by three-quarters of a percentage point again. It has said that its fight against inflation will require borrowing costs to go higher. The Bank of England too is looking into doing the same today, its biggest rate rise since 1989 as it struggles with the highest inflation in 40 years.

Read more: Investment India: Bad funding weather in Q3 expected to continue for next 12-18 months

Some of Europe’s largest banks cautioned of rising risks as the economy sputters after announcing stronger-than-expected profits, aided by a trading boom in volatile markets and higher interest rates.

Businesses around the world are starting to feel pinches in different ways. Wall Street king Morgan Stanley is likely to start a fresh round of layoffs worldwide in the coming weeks, as dealmaking business takes a hit.

Shipping group Maersk warned of slackening demand for transport and logistics and cut its forecast for container demand this year, despite the fact that it beat third-quarter earnings expectations.

Toyota announced a worse-than-expected 25% cut in quarterly profit and lessened its annual output target, as the Japanese auto giant fights rising material costs and a annoying semiconductor shortage.

US companies from big tech giants like Alphabet, Microsoft, GE, and toymaker Mattel reported huge slowdowns in growth or cautioned of worse things to come, inciting recession fears and pushing down stocks.

Read more: What is driving the XaaS economy in India?

Reckitt Benckiser, maker of Dettol cleaning products and Durex condoms, declared a fall in sales volumes in Q3 and cautioned of pressure on consumers worldwide.

As a silver lining, Mercedes-Benz increased its full-year profit forecast based on higher demand for luxury cars and cost savings offset the supply chain bottlenecks that have hampered industry output this year.