The Winklevoss twins lost the biggest social-network showdown ever when their rival, Mark Zuckerberg, walked away with Facebook. Now they are trying again—with a social network for professional investors.

Flush with at least $65 million from the settlement of a legal battle with Mr. Zuckerberg and Facebook Inc., Tyler and Cameron Winklevoss are backing fellow Harvard alumnus Divya Narendra, their ally in the Facebook fight, in the investment website. The Winklevosses have put $1 million into SumZero, which was founded by Mr. Narendra and another Harvard alum Aalap Mahadevia, in 2008.

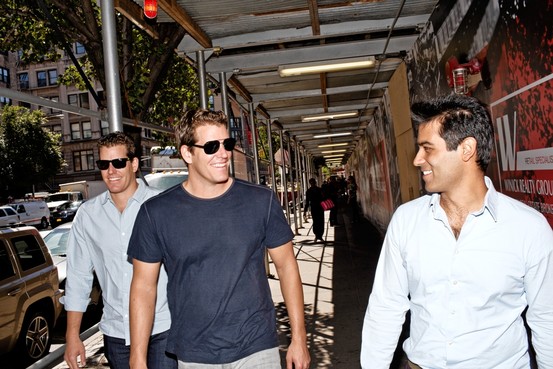

“The band is back together,” Tyler Winklevoss said over lunch at Manhattan’s Ace Hotel with his brother Cameron and Mr. Narendra.

The Winklevosses and Mr. Narendra became famous courtesy of the 2010 film “The Social Network,” which chronicled the founding of Facebook and legal disputes between Mr. Zuckerberg and his early collaborators.

In person, the twins are more soft spoken than their counterparts in the movie. One brother would often finish the other’s thoughts as they each dined on chargrilled lamb burgers.

In December 2002, the twins and Mr. Narendra convened in a dorm room during their junior year to discuss Harvard Connection, an idea for a social network. The name was later changed to ConnectU, a site they hired Mr. Zuckerberg to help design in late 2003. Early in 2004, Mr. Zuckerberg formed Facebook and subsequently parted ways with the group, sparking a battle over ownership rights to what became a social-media giant.

Until last year, the twins’ lives were almost entirely consumed by the litigation and a different kind of battle: a quest for victory as Olympic rowers.

Both came to an end last year. Last December, the twins decided not to make a run for the London Games. They also reached a final settlement that included cash and stock in Facebook. The settlement reportedly awarded the twins $20 million in cash and $45 million of private Facebook stock at a time when the company was valued at $15 billion. (Today, Facebook has a market capitalization of $47.1 billion. Including restricted stock units and options granted to employees, its market cap is $60.3 billion, down from $104 billion at the time of its IPO.)

The twins declined to discuss the terms of the settlement.

In February the brothers formed Winklevoss Capital as a vehicle to invest their personal wealth. Their first investment in June was SumZero, which brings together investors to share trading ideas and research.

SumZero.com has parallels with the first versions of Facebook. For one, Mr. Narendra believes the key to ensuring high-quality ideas was exclusivity. The site allows investors to become members only if they work on the “buy side.” SumZero defines that group as investment professionals at hedge funds, mutual funds, and private-equity firms. Analysts from the “sell side” such as Wall Street banks aren’t allowed.

“We’re offering the site as an alternative to sell-side research,” Mr. Narendra said. The site offers a weekly newsletter available to anyone but asks users for permission before placing their material in it.

The appeal for members is the chance to read ideas from other investors, but also to spread the word about investments they already have.

The four-year-old site has about 7,500 members, and Mr. Narendra says he continues to review each application personally, rejecting about 75% of them. Even the Winklevoss twins weren’t given access to the site before they become part owners of it.

Tyler likens the concept to the early days of Facebook, when only people with “.edu” email addresses from certain universities were eligible to join. “It’s the same check,” he says.

The site also requires that members regularly submit trading ideas to maintain access to material posted by others. Members who don’t submit an idea for six months lose access to the database, but can get it back if they post a new one. The site also lets users follow one another and set up alerts for material posted about stocks they track.

While these members use the site free, SumZero sells limited access to outside investors, who pay $129 per month for a small number of investment ideas that Mr. Narendra chooses after getting permission from their authors.

Longer term, Mr. Narendra may charge large institutions for access so they can seek out talented buy-side investors to manage money. Some big institutions may also be willing to pay for the right to view research without submitting ideas.

Mr. Narendra said the site experimented with advertisements, but he thought they cheapened the user experience.

The Winklevosses plan to be more than passive investors. SumZero will move into their Manhattan office space near Madison Square Park when it opens in October, allowing them to work with Mr. Narendra frequently. “We want to get involved and really roll up our sleeves,” Tyler Winklevoss said.

“We always saw ourselves in careers as entrepreneurs or angels,” said Cameron. “My favorite toy as a kid was Legos. I loved building things, and that’s what we’re doing with SumZero.”

Via: Wall Street Journal