The application of Environmental, Social, and Governance (ESG) as a tool for business resilience is comparatively a novel turn for India Inc. Traditionally, the concept of business resilience was limited to the consideration of financial performance. Today, the importance of ESG integration in India has been spurred into motion by major players in the economy.

According to a study conducted by CRISIL in May 2022, out of 586 public companies across 53 sectors, only one-fifth of the companies published a sustainability report. CRISIL also found that compared to last year’s study, 12 companies published detailed sustainability reports for the first time and of the companies that did earlier, nine are yet to publish for FY 2021-22. With mandatory reporting requirements such as Business Responsibility and Sustainability Reporting (BRSR) coming in, India Inc. is left with no choice but to dedicate itself to meaningful ESG integration.

A direct consequence of low corporate disclosure and reporting can be observed in low ratings and rankings that India Inc. fetches based on the trending ESG norms and performance measures. Immature execution can lead to miscommunication and under-reporting from the corporate side along with making the Indian market uncertain for new ESG investments. Why is it that despite increasing top-down pressure, ESG execution in India is still not quite up to the mark?

First, whilst there is ample regulatory pressure on corporates for transparency on ESG matters, there are no such obligations for Indian investors. The integration of ESG for India Inc. remains very piecemeal due to this precise lack of stewardship from the investor side, which otherwise, globally, is a huge driver. It can be said that India Inc. is not compelled enough to report and monitor relevant and necessary ESG metrics.

Second, there is an industry-wide dearth of experienced ESG professionals. India Inc. is grappling to come to terms with the implications of BRSR and other sector-specific regulations seeking compliance on various ESG metrics.

Companies would need to set up their in-house ESG teams, who would need talent not only to understand the business mechanisms and regulatory practices but also be adept in dealing with a VUCA (Volatility, Uncertainty, Complexity & Ambiguity) world outlook and manage multiple stakeholder expectations. Moreover, due to a lack of ESG professionals with standard skillsets, India Inc. is facing a major roadblock in meeting its declared national targets, such as its commitment to achieve NetZero by 2050.

India is a developing country. Owing to that, we see a general lack of direction when it comes to ESG integration. As a result of being in this transitionary phase, there are still several challenges that are yet to be addressed. An overall ESG streamlining across India Inc. would require tremendous financial as well as technical support. According to a joint report by GE-EY, to fulfil its 2070 net-zero targets alone, India would need an investment of over USD10 trillion. A clear testament to this is the fact that we still see Indian companies that:

- Do not differentiate amongst CSR implementation and ESG execution

- Are at constant risk of reputational damage due to the mismanagement of ESG-related controversies

- Are heavily reliant on global funding as well as technological collaborations for substantial progress towards carbon goals

- Are not able to effectively capitalise on their climate risk management processes to identify potential opportunities

- Are unable to secure global investments and funding opportunities due to unsatisfactory their ESG integration

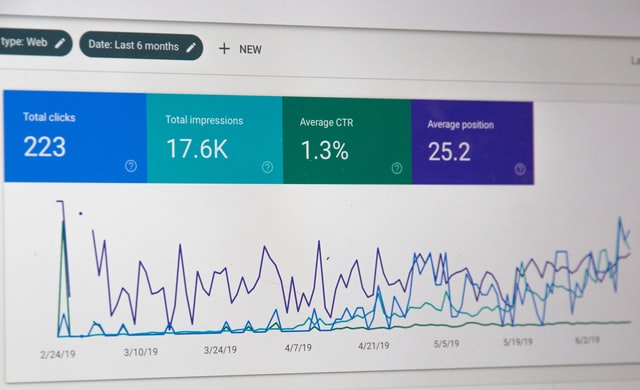

The potential market projection for ESG-focussed funds is growing fast, the AUM (Asset Under Management) for which has grown by 128% in two years, as of November 2021. However, globally, India is well below many countries and markets with only 22 ESG funds as compared to Belgium (148), Pakistan (159), China (162), Germany (352), the US (612) and even Cayman Islands (28) and Luxembourg (2,135).

Nevertheless, this just indicates the potential growth opportunities for India Inc. if ESG execution is taken seriously. India Inc. needs to go beyond just fulfilling the generic ESG expectations of all its stakeholders. Instead, opportunities should be explored to create value and make effective ESG execution synonymous with ensuring business resilience.

Pallavi Singh

Guest contributor Pallavi Singh is the Head of ESG Products Solutioning at SG Analytics, a global insights and analytics company that offers data-centric research and contextual analytics services across BFSI, healthcare, media and entertainment, technology, and other sectors. Any opinions expressed in this article are strictly that of the author.